We Have Answers to Your Questions

Homeland Title Settlement Agency in Glen Allen, VA, has answers to some of your common questions below. We can be reached at 804-935-0043.

What Does Title Insurance Do?

What to Expect During the Closing Process?

Additional FAQs

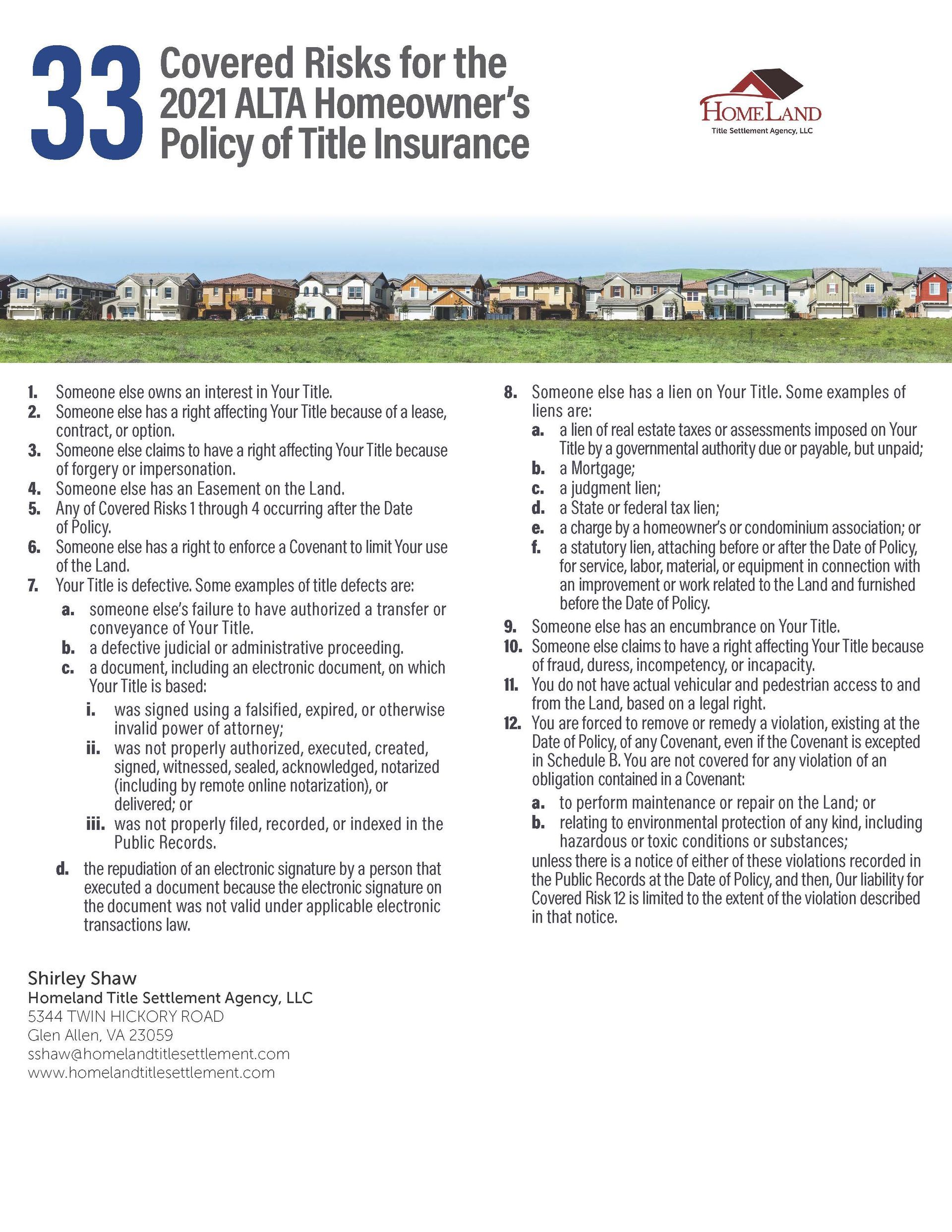

Covered Risks for the 2021 ALTA Homeowner's Policy of Title Insurance

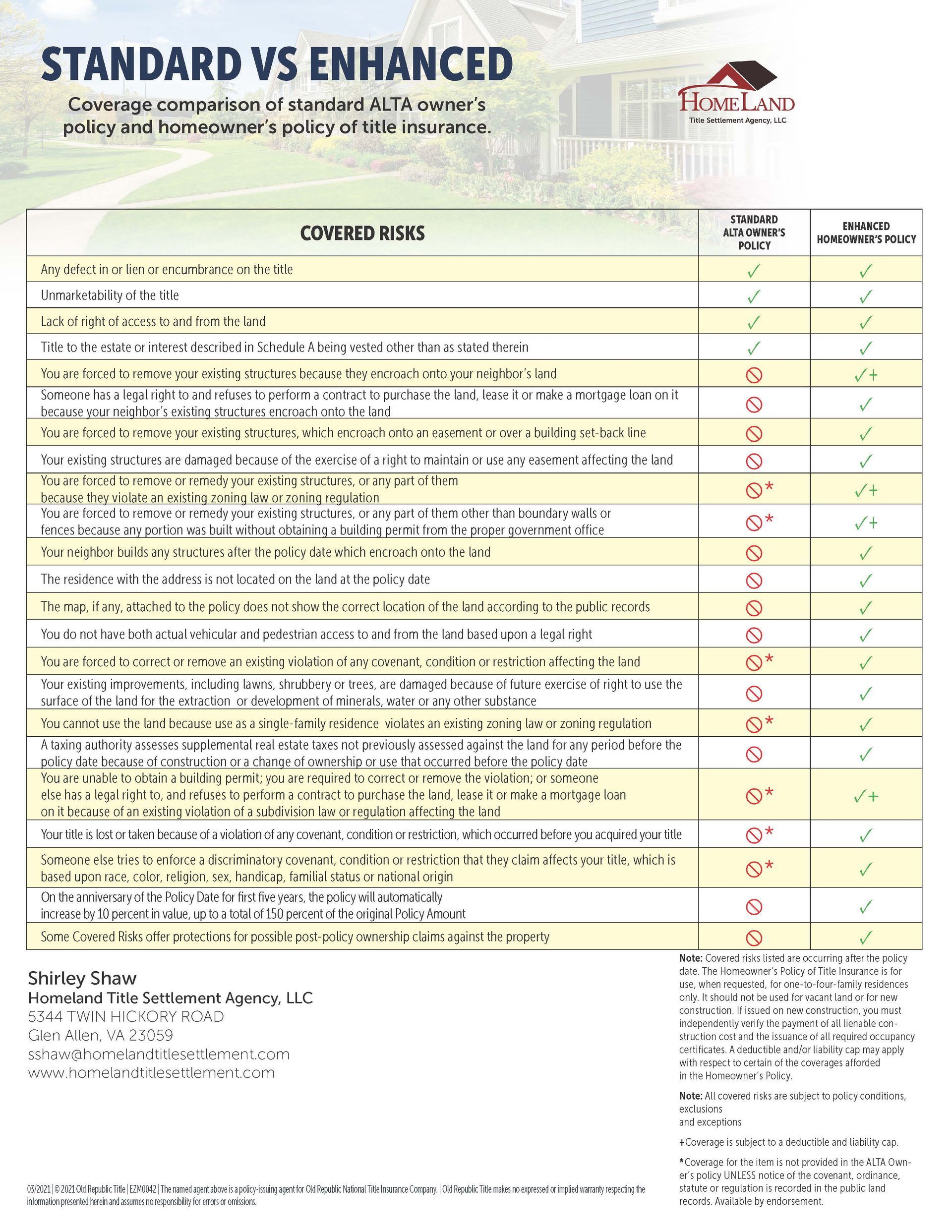

STANDARD VS ENHANCED

Reach Us Today to Get Started

If you have any other questions, we have a friendly and knowledgeable team ready to answer them. Give us a call, and we’ll be happy to help.